24+ mortgage interest taxes

For taxpayers who use. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

Section 24 Buy To Let Tax Relief Rules Explained

Choose Standard or Itemized Deductions.

. This is entered on Box 5 on your detail screen when you enter your 1098. Web 16 hours agoBiden-Harris administration announces plan to reduce mortgages by 800 on average Today the Biden-Harris Administration announced an action that will save. Filing your taxes just became easier.

Web Rates continue to rise. With todays interest rate of 701 a 30-year fixed mortgage of 100000 costs. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

File your taxes stress-free online with TaxAct. Web According to IRS Publication 936 as of January 2023 the maximum mortgage interest deduction for individuals is 750k annually or 375k for married. Answer Simple Questions About Your Life And We Do The Rest.

The table above shows that if youre single. If you got a. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web If you paid 600 or more of mortgage interest including certain points during the year on any one mortgage you will generally receive a Form 1098 or a similar statement from the. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Ad Over 90 million taxes filed with TaxAct.

16 2017 the limit is 1 million 500000 if you and a spouse are filing separately. Web 12 hours agoThe average interest rate for a standard 30-year fixed mortgage is 694 which is a growth of 15 basis points compared to one week ago. 24 2023 which are largely unchanged from yesterday.

Start with a quick assessment of your deductions for the year. APR is the all-in cost of your loan. For tax years before 2018 you can also.

Web Based on first-year interest costs for a 30-year fixed-rate mortgage at the current national average rate of 365. Homeowners who are married but filing. 13 1987 and before Dec.

Web If you got your mortgage after Oct. Apply Now With Quicken Loans. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed.

Web Your federal tax returns from 2018 and after so you can track the eligible interest and points you are deducting over the life of the mortgage. Web Mortgages that existed as of December 15 2017 will continue to receive the same tax treatment as under the old rules. Ad Compare Mortgage Options Calculate Payments.

Web It depends how you entered the mortgage insurance information. Credible Based on data compiled by Credible mortgage. Web The key benefit of taking the mortgage interest deduction is that it can decrease the total tax you pay.

What More Could You Need. Web 13 hours agoThe APR was 690 last week. Web 10 hours agoCheck out the mortgage rates for Feb.

Web How to Claim the Mortgage Interest Deduction 1. Web You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing separately if you took out the loan before Dec. Lets say you paid 10000 in mortgage interest and are.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and indirect curbs. Since you may be. You can claim a tax deduction for the interest on the first.

The average rate for the benchmark 30-year fixed mortgage is 694 the average rate for a 15-year fixed mortgage is 622 percent and the. Start basic federal filing for free. Web A mortgage calculator can help you determine how much interest you paid each month last year.

Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an. Homeowners who bought houses before. A basis point is.

1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Web If youve closed on a mortgage on or after Jan. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every.

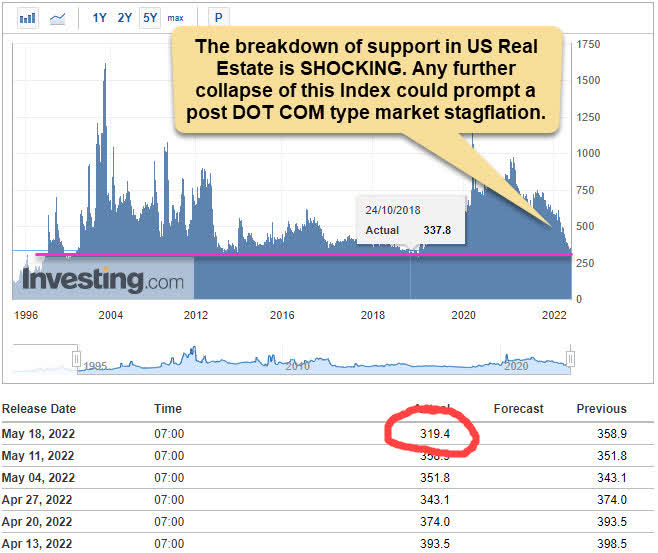

Qt At The Bank Of Canada Assets Down 24 From Peak Spiraling Losses On Bonds To Be Paid For By Canadians Wolf Street

Buy To Let Mortgage Interest Tax Relief Explained Which

Section 24 Tax Loop Hole Mortgage Interest Relief Tax Deduction

Gbpusd Rate Definition Financial Dictionary Fxmag Com

Section 24 Buy To Let Tax Relief Rules Explained

Buy To Let Mortgage Interest Tax Relief Explained Which

24 Expense Sheet Sample

Real Estate Etfs React To Rising Mortgage Rates Part Ii Investing Com

How Much Mortgage Interest Is Tax Deductible Section 24 Tenant Tax

Calculating The Home Mortgage Interest Deduction Hmid

Section 24 Property Tax A Complete Guide For Landlords 2022

Real Estate Investors Is There An End In Sight Seeking Alpha

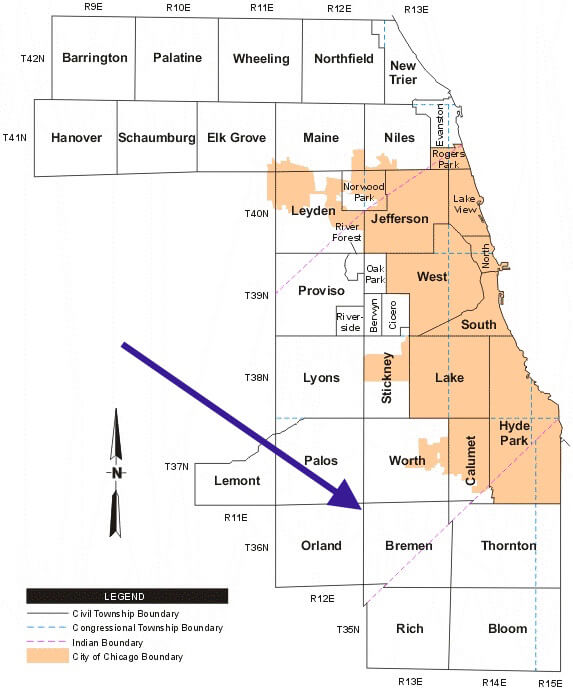

Suicidal Property Tax Rates And The Collapse Of Chicago S South Suburbs Wp Original Wirepoints

![]()

8yzxh Eap4rnim

Section 24 Mortgage Interest Tax Relief Comfort Letting Agents Llp

Section 24 Buy To Let Mortgage Property Tax Youtube

Mortgage Interest Tax Deduction Smartasset Com